Make a Tax Payment

Click here to go directly to the Real Estate site

The maximum payment that can be accepted online is $10,000.00. If you need to make a larger payment, please make multiple transactions.

Instructions for making an online tax payment:

Go to the Hocking County Real Estate Page and search for the property that you want to pay on.

Find and click the Parcel Number you are looking for in the Parcel Results page if it comes up.

Once on the Parcel Information page, you will find different categories Owners, Summary etc. ...

Scroll down until you see the category Pay Online.

If a payment is available, you will see a Full Payment box and a Make Payment button.

Click the Make Payment button.

If the Full Payment box and Make Payment button is not available, you will see "No payments can be made at this time" you do not have a current balance. Please contact the Treasurer to set up a pre-pay account in order to make future payments.

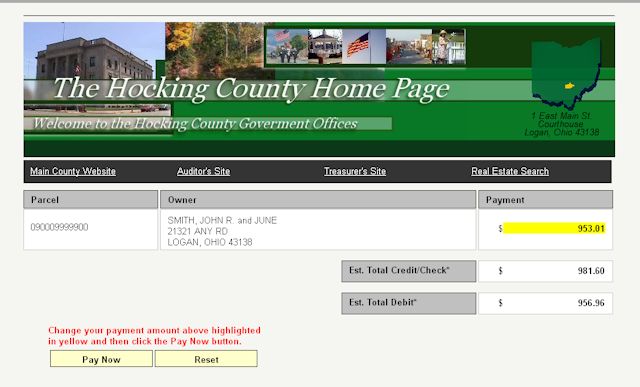

You will now be sent to the payment confirmation screen. Please change the amount that you wish to pay in the yellow box and then click the Pay Now button. After this screen you will not be able to change your payment amount, please make sure it is correct before proceeding.

The next screen takes you to our payment provider, LexisNexis. At the end of the checkout process you will be able to print a receipt. Payments made after 11:59 P.M. will be applied on the next business day. Any payments before Midnight made on a due date will be applied on that day.